The non-alc beverage space is changing fast, and not every brand is keeping up. New trends pop up by the dozen: functional ingredients, hybrid drinking, and phrases like “social wellness.” Jeff Cantalupo, founder of Listen Ventures, has been paying close attention. As an early backer of wellness brands like Calm and beverage brands like Go Brewing, he knows what works and what fizzles out. In this conversation, he shares insights from his recent consumer research, common misconceptions brands fall prey to, and the red (and green) flags investors look for in the non-alc space.

Dry Atlas: Let’s start with the big picture. What are two or three consumer behavior shifts everyone in the beverage space should understand right now?

Jeff Cantalupo: At a macro level, wellness is driving nearly everything. You’re seeing dollars shift across categories: clean ingredient beauty, better-for-you food, and, more recently, alcohol alternatives. As part of that, the idea of “drinking” itself is evolving.

It’s become centered around being more intentional with what you’re drinking. Maybe it’s drinking fewer drinks, choosing functional ingredients, or mixing and matching non-alcoholic and alcoholic options depending on the occasion. That’s what we refer to as “hybrid drinking.”

Fitness trackers are another factor. When people wake up and see poor recovery scores after drinking, it reinforces that shift. Meanwhile, you’re seeing functional beverages across the board, in energy drinks, sodas, and increasingly in non-alcoholic and infused products. The behavior has become focused more on deliberate choice than on simply giving something up.

DA: Alcohol has long been tied to status, whether it’s James Bond’s martini or the girls from Sex and the City. Is that changing?

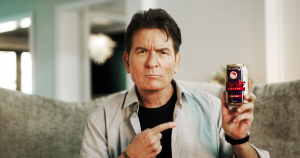

JC: Definitely. Symbols evolve, but they don’t disappear. Great consumer brands often rely on identity and ritual, and that’s still true with non-alcoholic and infused beverages. Take Liquid Death, for example. They made it cool to hold a can of water at a concert. That’s identity branding.

What you hold in your hand says something. And non-alcoholic brands should absolutely think about that. What are you igniting in the consumer when they badge themselves with your product? We still want to look good, feel sophisticated, feel “in.” We’re just choosing different signifiers.

DA: Let’s talk about the Gen Z effect. There’s a lot of buzz about how they’re drinking less. Is that who’s driving this movement?

JC: I’m a brand guy, so I’ll always say psychographics over demographics. You can’t build a meaningful brand on age alone. You have to understand what drives your consumer, whether they’re 27 or 67.

I think we underplay the older generations here. I’m really curious about mindful parents and the over-60 crowd, both of whom might be moving away from alcohol and looking for sophisticated replacements. These consumers have spending power, too. We see brands get lazy with their targeting. Saying you’re going after “the soccer mom” doesn’t mean much if you don’t understand the psychology of her life, habits, and desires.

DA: What about that gap between what people say they want and what they actually do? What are you seeing there?

JC: The say-do gap is huge. In our most recent study on THC beverages, 58% of consumers said they were using those products to reduce alcohol consumption, not to eliminate alcohol entirely. That’s an important nuance. People want options. Maybe they drink alcohol on weekends but not on weekdays.

There’s also a lingering stigma around THC. A lot of people say they believe THC is healthier than alcohol, but they still don’t want to be seen drinking it in public or in front of their kids. Especially if they’re discovering THC through beverages and not dispensaries. They might be curious, but still hesitant.

DA: So what are brands getting wrong about their audience’s motivations?

JC: I think one big misconception is that consumers treat THC beverages like alcohol, just one-to-one. In reality, they’re not always used in the same moments or for the same reasons. Some occasions do overlap, but others are entirely new. That’s exciting, but also tricky for brands that don’t do the research.

Another misconception? Thinking today’s consumer is tomorrow’s. Just because 10 mg THC drinks are selling well today doesn’t mean that’s what new customers will want long-term. You need a spectrum of offerings. And finally, I think too many brands ignore what it means when a consumer makes a beverage decision for health reasons, but the product itself is loaded with sugar. You can’t position yourself in the wellness space and then forget that ingredients matter.

DA: What brands are doing a good job of bridging that gap?

JC: I’d call out a few. Uncle Arnie’s is one; they started in dispensaries but have expanded thoughtfully. Their branding, formulation, and community are all aligned with who they’re talking to. Happi is another great example. The founder, Lisa Hurwitz, has built a strong community of women around replacing those one or two weekday glasses of wine. And Magic Cactus is doing something interesting, too. Their cactus water base, multi-cannabinoid formula, and brand storytelling all support a very specific occasion we identified in our research: the bonfire. The idea of intimate gatherings, deeper conversation, and shared experience.

DA: From a messaging standpoint, what actually resonates with consumers?

JC: Most brands are still in that category creation phase. So, the early messaging is functional. You’ll see phrases like “no hangover” or “buzz without the booze.” Those messages can work for discovery, but they don’t build long-term brand loyalty.

Eventually, you need something more emotional. Think: Corona’s “Find Your Beach.” Red Bull’s “Gives You Wings.” Or even Hiyo’s “Feel the Float.”

And for infused products, visuals matter. Don’t put weed leaves all over your packaging if your target consumer doesn’t want that. Design with their comfort in mind.

DA: What’s your take on buzzy phrases like “mindful drinking” and “sober curious”?

JC: To be honest, I don’t hear those phrases from consumers. They’re more marketing shorthand than actual language people use. What I do hear is moderation. Consumers talk about wanting to feel better, whether that’s in the moment or the next day. So, they might skip drinks during the week or choose something lighter. That’s real.

And while hybrid drinking is happening, alcohol isn’t going anywhere. It’s still a $260 billion industry in the US. What brands shouldn’t do is position themselves as anti-alcohol. If most of your audience still drinks alcohol occasionally, you don’t want to alienate them. Define yourself by what you are, not what you’re not.

DA: Let’s shift to your investor perspective. What makes a beverage brand fundable to you?

JC: First, founder obsession with their consumer. Who are they building for? What occasion are they trying to own? Does the product actually meet that consumer’s needs?

From there, we look at brand narrative and differentiation. Why this brand? Why now? Is it just another THC seltzer, or does it have a point of view?

Then, there’s the business side. Beverage is hard. It’s capital-intensive. So, you need to show a path to sustainable margins. We look at ingredient costs, packaging, canning, all of it. Especially in THC, where we know price compression is coming. If you’re barely breaking even now, what happens when the market tightens?

We also think about future portfolio construction. Big companies are going to build portfolios of functional and alcohol alternative beverages, just like they did with beer or spirits. We’re always asking: where does this brand fit in that future world?

DA: And on the flip side, what are the biggest red flags?

JC: Honestly? When someone sends a deck and it’s clear there’s no real brand. There are a lot of products on shelves, but very few true brands. And I get it. We’re in a moment where demand is high, so it’s easy to launch something and see early sales.

But the moment that demand evens out, the products without strong brands behind them will fade. So we’re looking for brand DNA. For founders who understand why their product exists, who they’re building it for, and what community they want to build around it. That’s what endures.

This interview has been edited for length and clarity.