Partner Content: Rho

Growth is a great problem to have… until it starts feeling like one. For beverage founders, that usually happens when DTC orders pick up, new retail accounts open, and your once-simple systems start showing their cracks.

Suddenly, you’re tracking trade spend in Google Sheets, managing invoices over email, and asking your operations manager to “just keep an eye” on cash flow. That may be fine at first, but it can quickly devolve into chaos.

Every small inefficiency (a late approval, a missing receipt, an untracked charge) compounds as you scale. And what used to be manageable admin work starts to quietly drain the business: in time, money, and momentum.

The Hidden Friction of Growth

The trouble with most beverage founders is that financial infrastructure simply doesn’t lie in their zone of genius. While it must be tackled, it seems to slip through the cracks when compared to more pressing questions about manufacturing and distribution.

The truth is, most banking platforms weren’t built for you. These legacy systems weren’t designed for fast-moving CPG companies managing multiple vendors and complex marketing budgets. Even so-called “startup-friendly” neobanks often fall short once your team grows beyond five or ten people.

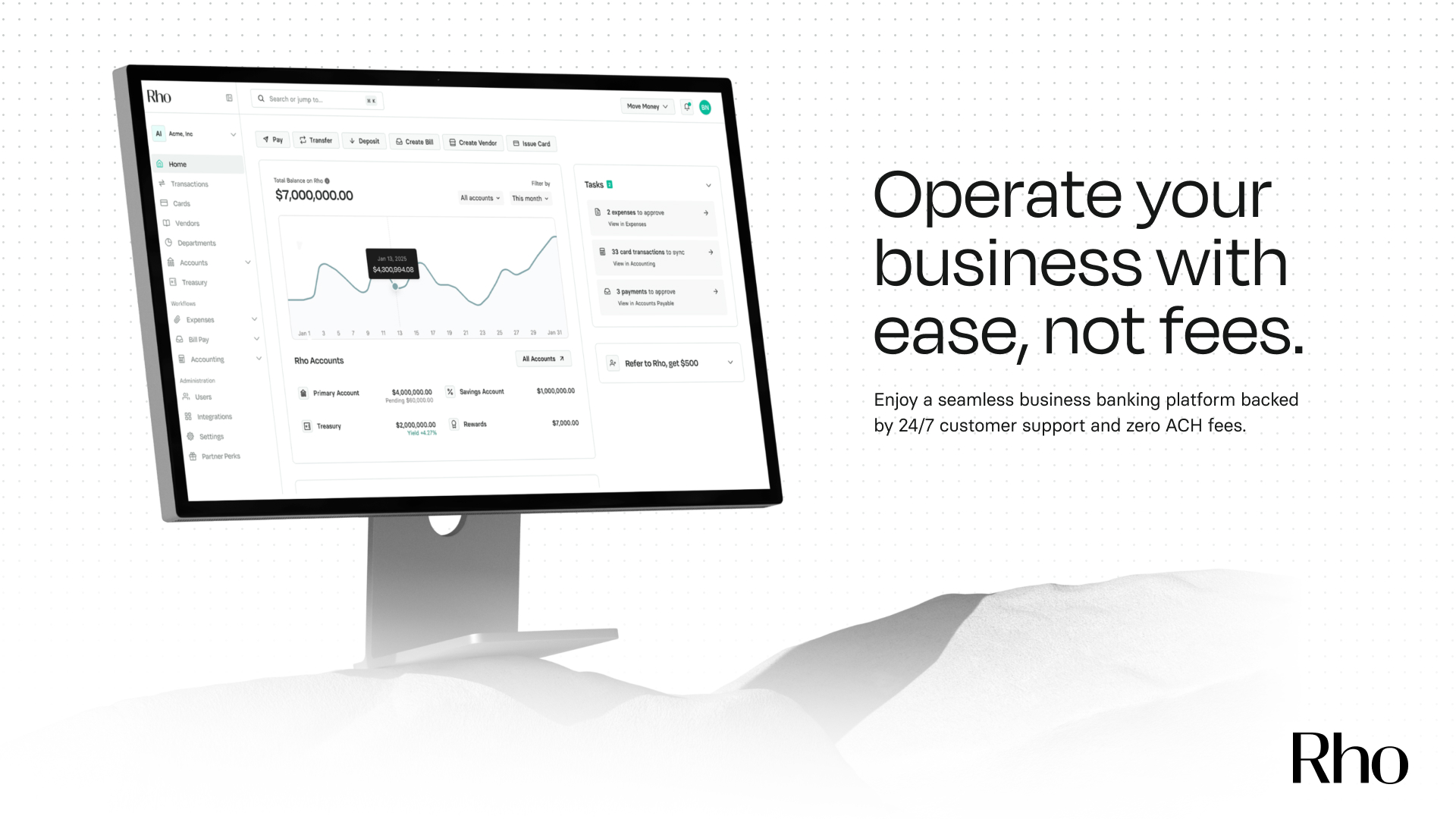

That’s where Rho comes in: a financial platform built to grow with you, from inception to IPO.

What Scaling Teams Really Need

Instead of a standard bank account, your financial system has to act as a command center.

Rho unifies banking, corporate cards, accounts payable, and budgeting in one place. This removes any of the friction between finance and operations that beverage founders live with for far too long.

Here’s what that looks like in practice:

- Trade and marketing spend: Every sampling event, merch order, and influencer payout can be tracked to a specific budget line in real time.

- Vendor management: Automate invoice approvals and recurring payments to your co-packer, distributor, and design studio without the endless email chains.

- Cash flow clarity: See exactly how much runway you have left, and which departments are burning through it fastest.

- Distributed control: Give your team members their own spend cards with custom limits and approval flows.

When your systems work like this, you spend less time chasing receipts and more time focusing on the things that actually move your brand forward.

Finance as a Competitive Edge

When your financial systems are dialed in, your team moves faster, spends smarter, and stays aligned. For beverage companies, where margins are thin and launch cycles are intense, that kind of agility is everything.

Think about how quickly priorities shift in this space: one week you’re scaling your DTC channel, the next you’re re-forecasting for a new distributor partnership. Having real-time financial visibility makes these transitions seamless.

Founders who can see their full picture at any moment don’t just react faster; they make better decisions.

How Rho Differs from the Rest

Where traditional banks give you tools, Rho gives you systems.

-

- Unified platform: Banking, cards, accounts payable, budgeting, and reporting all live under one roof. No more toggling between six different apps just to close your books.

- Automated controls: Set custom spend rules by department, vendor, or project (without adding headcount or micromanaging).

- Real-time visibility: Dashboards let you instantly understand cash flow, burn rate, and budget adherence.

- Scalable infrastructure: Whether you’re still bootstrapped or post-Series B, Rho grows with you. No migration headaches here.

- Maximized returns: with up to 2% cashback and industry-leading treasury rates, Rho makes your cash work as hard as you do.

- White-glove customer support: Founders are on a texting basis with their representatives at Rho, and Rho’s team will go to the end of the earth to see your business win.

For beverage founders, that level of precision is often what separates smooth scaling from operational overwhelm.

Built Around Founders, Not Finance Teams

Rho’s product philosophy is grounded in founder workflows. The team behind it understands that when you’re scaling, your day can start with anything from a production issue to a supply chain surprise.

That’s why Rho’s tools are built to fit around how founders actually work. Whether you’re approving a spend from your phone between meetings or reviewing your marketing budget before Expo West, Rho keeps everything where it belongs.

Running a beverage company is an exercise in constant motion. Every new SKU, retail partner, and marketing channel adds complexity. If your financial operations can’t keep pace, growth will feel heavier than it should. With Rho, scaling doesn’t have to mean slowing down.

If you’re still managing your finances across disconnected tools and gut checks, it’s time to upgrade. Explore how Rho helps fast-growing beverage brands run tighter ops with fewer resources.